All Categories

Featured

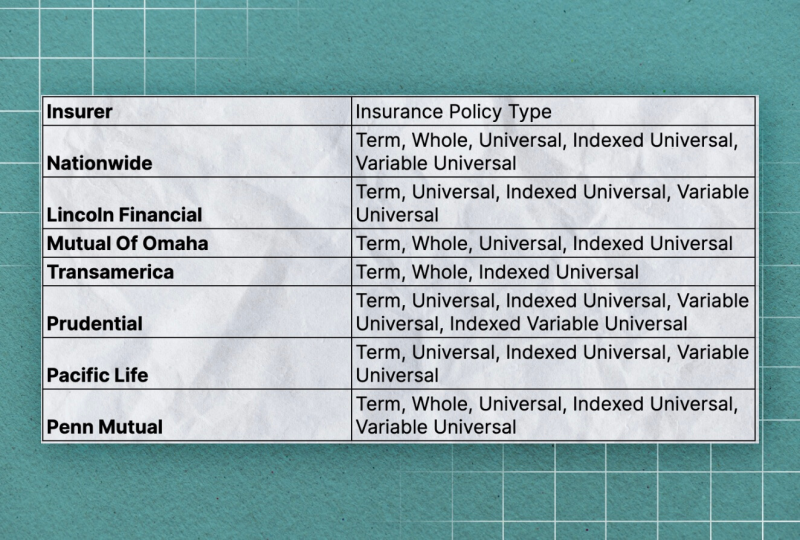

State Ranch representatives offer everything from home owners to vehicle, life, and various other prominent insurance coverage items. So it's simple for representatives to pack solutions for discounts and very easy plan monitoring. Many customers enjoy having actually one relied on representative manage all their insurance requires. State Farm provides universal, survivorship, and joint global life insurance policy policies.

State Farm life insurance coverage is generally conservative, supplying steady options for the average American household. If you're looking for the wealth-building possibilities of universal life, State Farm lacks affordable options.

Still, Nationwide life insurance policy plans are highly easily accessible to American families. It assists interested celebrations obtain their foot in the door with a reputable life insurance coverage plan without the much a lot more difficult discussions concerning investments, economic indices, and so on.

Even if the worst happens and you can't get a larger plan, having the security of a Nationwide life insurance policy might change a purchaser's end-of-life experience. Insurance policy business use medical exams to determine your danger course when using for life insurance.

Buyers have the choice to change rates each month based on life conditions. A MassMutual life insurance coverage representative or economic advisor can help customers make strategies with area for changes to satisfy temporary and lasting financial objectives.

Index Life Insurance Vs Roth Ira

Read our MassMutual life insurance evaluation. USAA Life Insurance Coverage is recognized for offering affordable and thorough monetary products to military participants. Some customers might be stunned that it uses its life insurance policy plans to the basic public. Still, military members delight in distinct benefits. Your USAA plan comes with a Life Event Alternative motorcyclist.

VULs include the highest possible danger and the most possible gains. If your policy doesn't have a no-lapse guarantee, you may even shed protection if your money worth dips below a specific limit. With so much riding on your investments, VULs need constant attention and upkeep. Therefore, it might not be a terrific option for individuals who simply want a death benefit.

There's a handful of metrics through which you can judge an insurance coverage firm. The J.D. Power client satisfaction score is a great alternative if you desire a concept of just how clients like their insurance plan. AM Finest's financial stamina ranking is another crucial metric to consider when choosing an universal life insurance policy company.

This is specifically important, as your cash value expands based on the investment choices that an insurance firm supplies. You must see what investment alternatives your insurance company deals and compare it against the goals you have for your plan. The very best means to find life insurance policy is to gather quotes from as many life insurance policy firms as you can to understand what you'll pay with each policy.

Latest Posts

Universal Life Policy Pros Cons

Iul Tax Free Retirement

Guaranteed Universal Life Insurance Quote